April Developer Round up

California Real Estate Development.

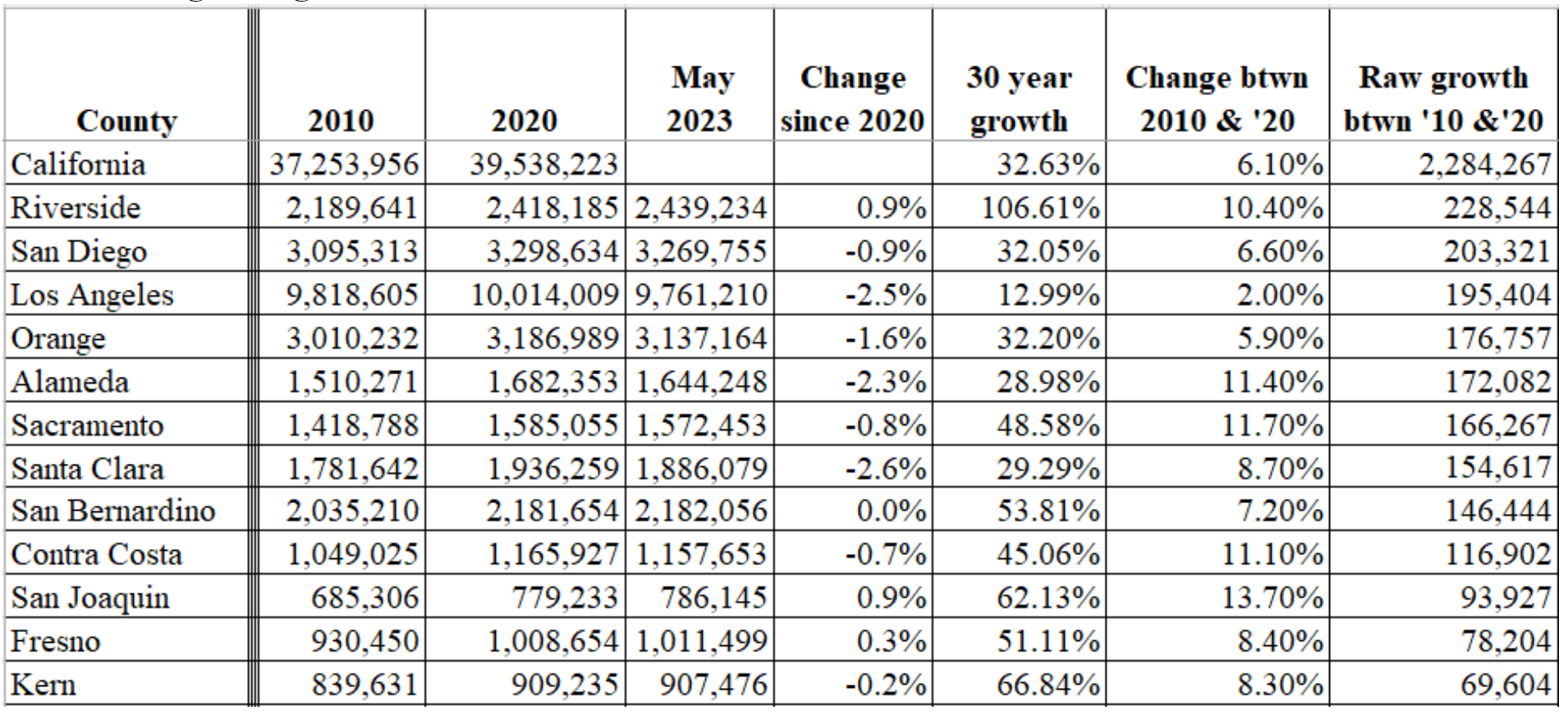

At PartnerBuilt thus far in April, we’ve reviewed over 50 small-to-mid sized development projects. Our work is focused on sourcing debt and equity for ground-up development deals. We follow and work with developers across the highest growth markets in the State. Although there is a huge amount of noise in the local and national press about residents leaving the State, the long term trends of growth in California are incredible, as California has grown by more than 10M people, equivalent to 32.6%, in the past 30 years.

Here is a breakdown of the fastest growing Counties in CA:

What is the Market Saying? The most interesting thing that we’ve seen in this elevated rate cycle with construction costs remaining high has been the drop in Clients pursuing rental/apartment projects. This is in part because Bank lenders have pulled back from this product type, and in part because developers can rarely pencil SFR/apartment projects. The NUMBER 1 constraint on their project financials is DSCR, as perm interest rates are pushing 7%. The Take-Outs that we’ve been assisting clients to find are EITHER 1) Bridge debt at Stabilization with a 1:1 DSCR at Prime, or a local bank that’s willing to underwrite the Year 1 Stabilization rate at a 1.2 DSCR at 200 BPS over the 5 Year Treasury.

On-going debate: We have an ongoing debate in legislation…Some Counties like San Diego allow Developers to pull Building Permits prior to FINALIZING MAPS (ie with approved TMAPS). OTHER JURISDICTIONS like Sacramento require Developers to FINALIZE their MAPS prior to pulling building permits (which takes time, coordination, process and $$). Why is this the case? Is it a tool that local jurisdictions use to slow down development projects?

Do you have thoughts on the subject? We’d love to hear from you,

Do you have experience working in either, or both scenarios? If so, we’d love to hear your thoughts on if there are any drawbacks to starting construction without final MAPS.

Lender Activity by Zip Code: Are you looking for a tool that can help you source bridge and construction lenders? If so, email us your Project’s Address or Zip Code , and we can share several options.